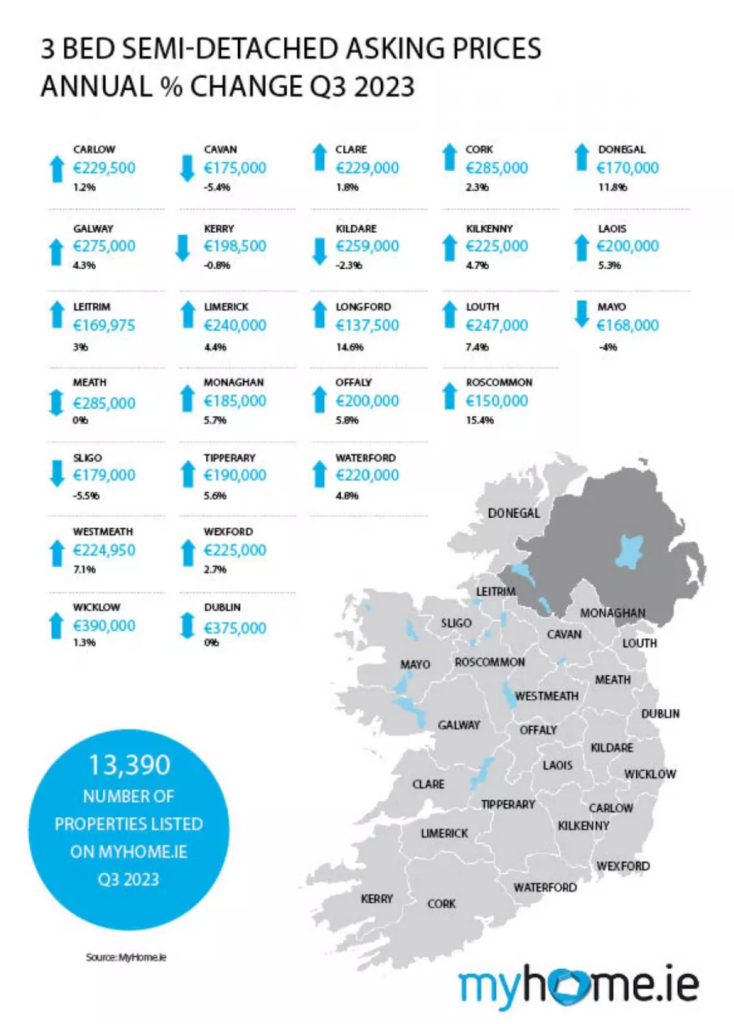

National annual asking price inflation is running at 4.1%

Fortunately, we have seen a slight drop in Kildare of 2.3% this quarter.

Take a look at this graphic to see it broken down on a county-by-county basis.

The period of falling house prices has come to an end

“The period of falling house prices we saw earlier in the year has come to an end, with the underlying imbalance between demand and supply providing fresh impetus to the market.” – Conall MacCoille, Chief Economist at Davy

Demand remains strong despite ECB rate hikes

The impact may not have yet been felt from these raised European Central Bank interest rates.

Supply shortage is a major concern and is leading to significant negative societal consequences

- Ireland’s housing stock per capita is now the lowest across a range of European countries

- Adults living at home with their parents now comprise over 10% of the population

- Numbers of employed adults living at home with parents and adults living with unrelated persons have grown hugely since 2016 (by 28% and 29%, respectively)

- While we saw 28,900 housing starts in the year to July, we needed 40,000-50,000 units annually to address our pent-up demand.

Ireland stands in stark contrast to UK and US, which have both seen price declines

This is largely due to the fact that demand for housing has remained high since the Irish economy has been performing far better than others – employment is already at 12% above pre-pandemic level.

Lack of supply threatens further deterioration in affordability over next two years as prices fall elsewhere

Davy Stockbrokers’ forecast of annual residential property price inflation of 1.5% is unchanged

In the Market for a New Property?

Check out what we have on offer at the moment and: