Summary of IPAV Residential Property Price Barometer July -December 2023

This week on our Blog we have taken the liberty of summarising the latest IPAV Residential Property Price Barometer for July -December 2023, taking out the key findings for your convenience. This report shows that a continued unrelenting demand for homes in Ireland persists, fueled by unprecedented population growth. Despite the Housing for All plan targeting 33,000 new homes annually until 2030, the report reveals that the figures need revision. With 32,695 builds in 2023, we’re inching closer to the target, but challenges remain.

Housing Market Overview:

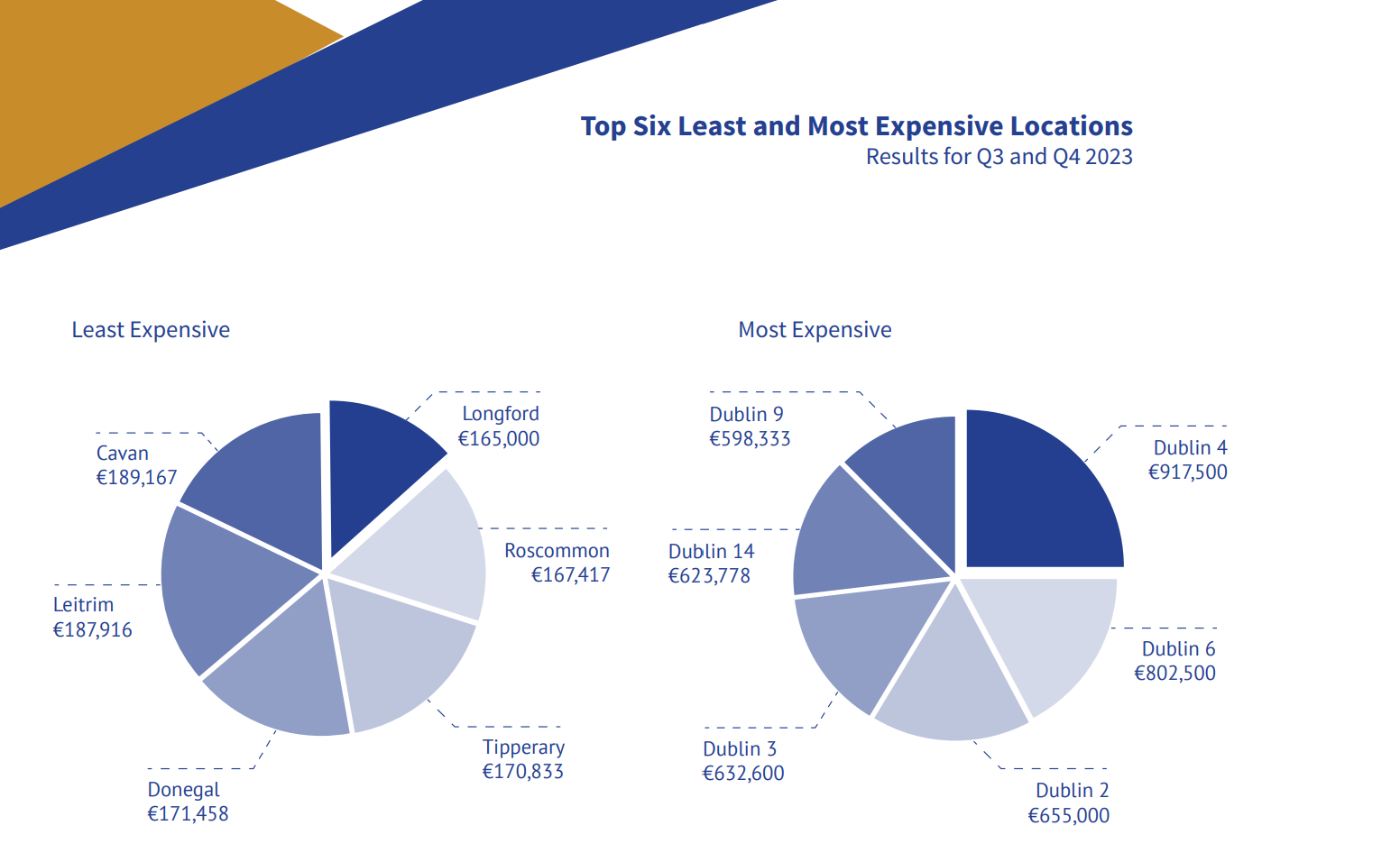

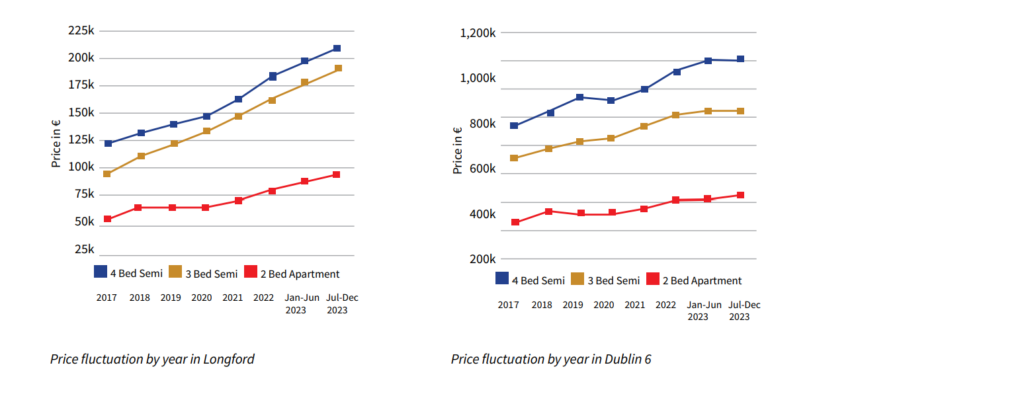

The Residential Property Price Barometer for the latter half of 2023 indicates a 2.99% overall increase in house prices. Notably, this rise is widespread, with many regions experiencing increases in the 5% to 7% range. However, Dublin areas, where prices are at the top end or supply has surged, saw lower increases, averaging around 1%. Two areas, Dublin 6 and Wicklow, even reported slight negative figures.

Factors Influencing the Market:

The population, now at 5.2 million, grew by 100,000 in the last year alone, creating a housing demand that outpaces supply. Prices, despite attempts to correct, remain resilient and could potentially rise by 5% in 2024. Auctioneers report a scarcity of supply, with strong demand from non-Irish nationals and returning emigrants.

Challenges in the Property Market:

The report identifies worrying signs for the upcoming year. A study found only 11,050 second-hand properties listed for sale nationally in January, representing a 27% drop from the previous year and a staggering 46% decline from January 2020. The Irish investment property market experienced a dismal 2022, with turnover down almost 70%.

Policy Considerations:

The report calls for specialized housing policy interventions, highlighting the need for a combination of coordinated measures. These include revisiting Rent Pressure Zone rules, supporting SME builders with low-cost finance, providing incentives to landlords, bringing vacant properties back into use, offering longer-term mortgages, and improving mortgage lending limits.

The Human Impact:

An ESRI study revealed a shocking deterioration in home ownership rates among those under 40, with Ireland having one of the lowest rates in Europe. The report emphasizes the urgency of addressing these challenges and not using the broader issue of home building challenges as an excuse for the country’s inability to meet the needs of its people, particularly the younger generation.

Ireland faces complex challenges in its housing market, requiring a nuanced and comprehensive approach. As the nation grapples with supply and demand imbalances, policymakers must consider specialized interventions to ensure the market meets the needs of its citizens. The report serves as a wake-up call, urging a reevaluation of existing policies and the introduction of targeted measures to navigate the intricate landscape of Ireland’s housing market.

If you would like some more advice on how best to navigate this tricky Property Market, Contact us today and check out What’s available.